Core Principles

Navigating the Future with Insight

At Bayesian Corp., our mission is to empower individuals and organizations to make informed decisions through data-driven insights. Guided by our core principles, we foster innovation, integrity, and excellence in all our interactions—with our teams, our clients, and the communities we serve. These values are the foundation of our culture, embraced and upheld by every member of our firm. They shape our vision and steer our company towards a future where knowledge leads the way.

Advancing The Digital Economy

Ecosystem of Opportunity

At Bayesian Corp., we catalyze the growth of the digital economy through an interconnected ecosystem of technology-driven companies. Our diverse portfolio, including Bayesian Data Analytics Systems, Credence Payment Solutions, and BCG Energy Systems, Bayesian Capital, harnesses advanced data technologies, secure payment infrastructures, and sustainable energy solutions to power progress.

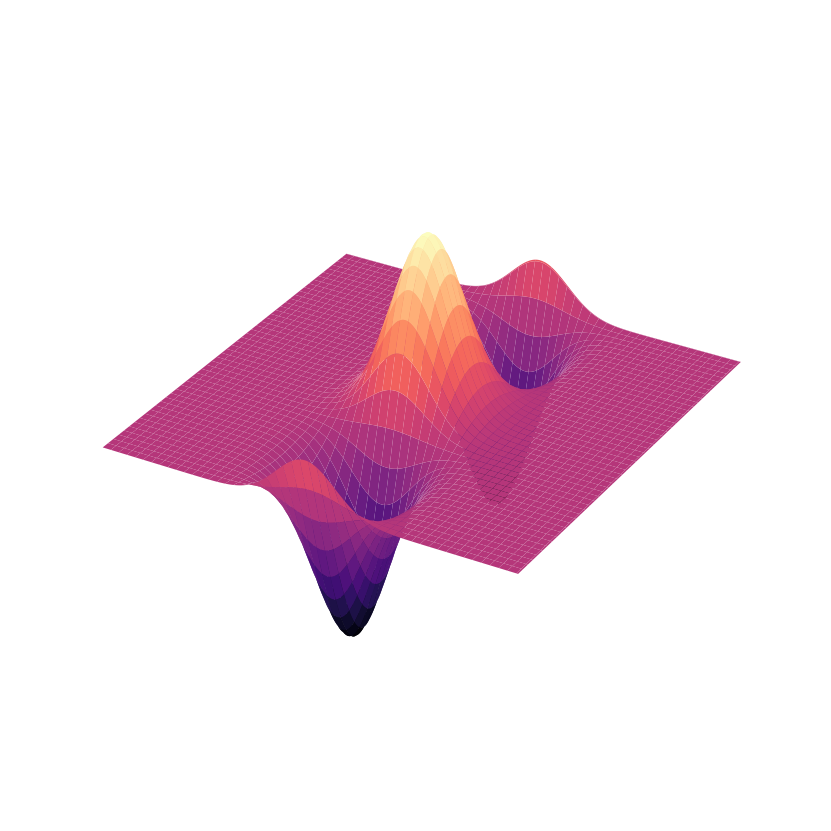

Five-Year Investment Performance Analysis

Navigating Investment Challenges Ahead

Hsitorically, portfolios with 60/40 asset allocation have yielded an average annual return of approximately 8%. However, considering the current economic environment marked by heightened function inflation, increased borrowing coss, and ecelerated economic growth, sustaining similar returns in the upcoming five-year period may necessiate strategic diversification into alternative asset classes.

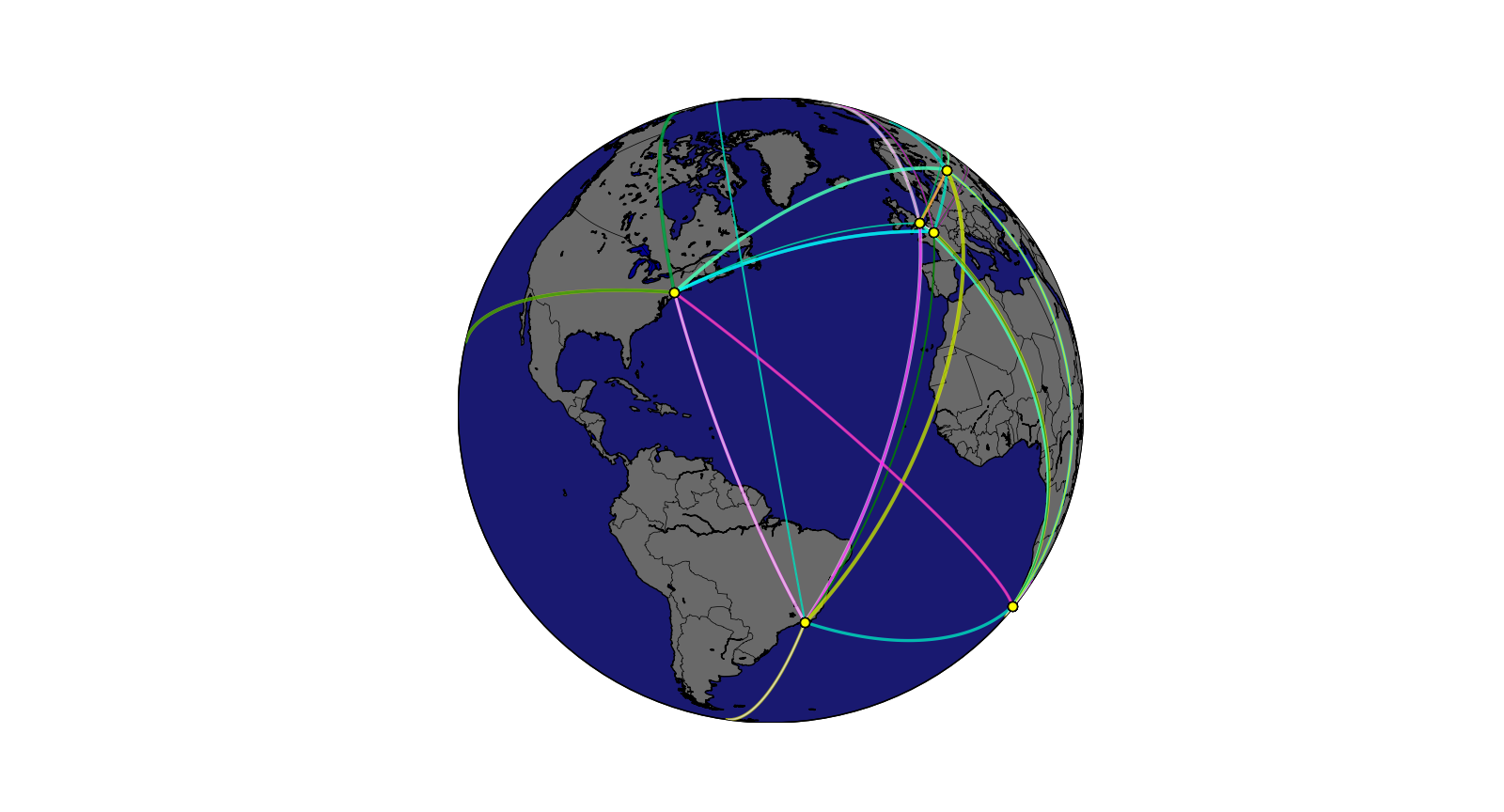

We are global

Delivering Excellence to Our Clients

At Bayesian Corp., we catalyze the growth of the digital economy through an interconnected ecosystem of technology-driven companies. Our diverse portfolio, including Bayesian Data Analytics Systems, Credence Payment Solutions, and BCG Energy Systems, Bayesian Capital, harnesses advanced data technologies, secure payment infrastructures, and sustainable energy solutions to power progress.

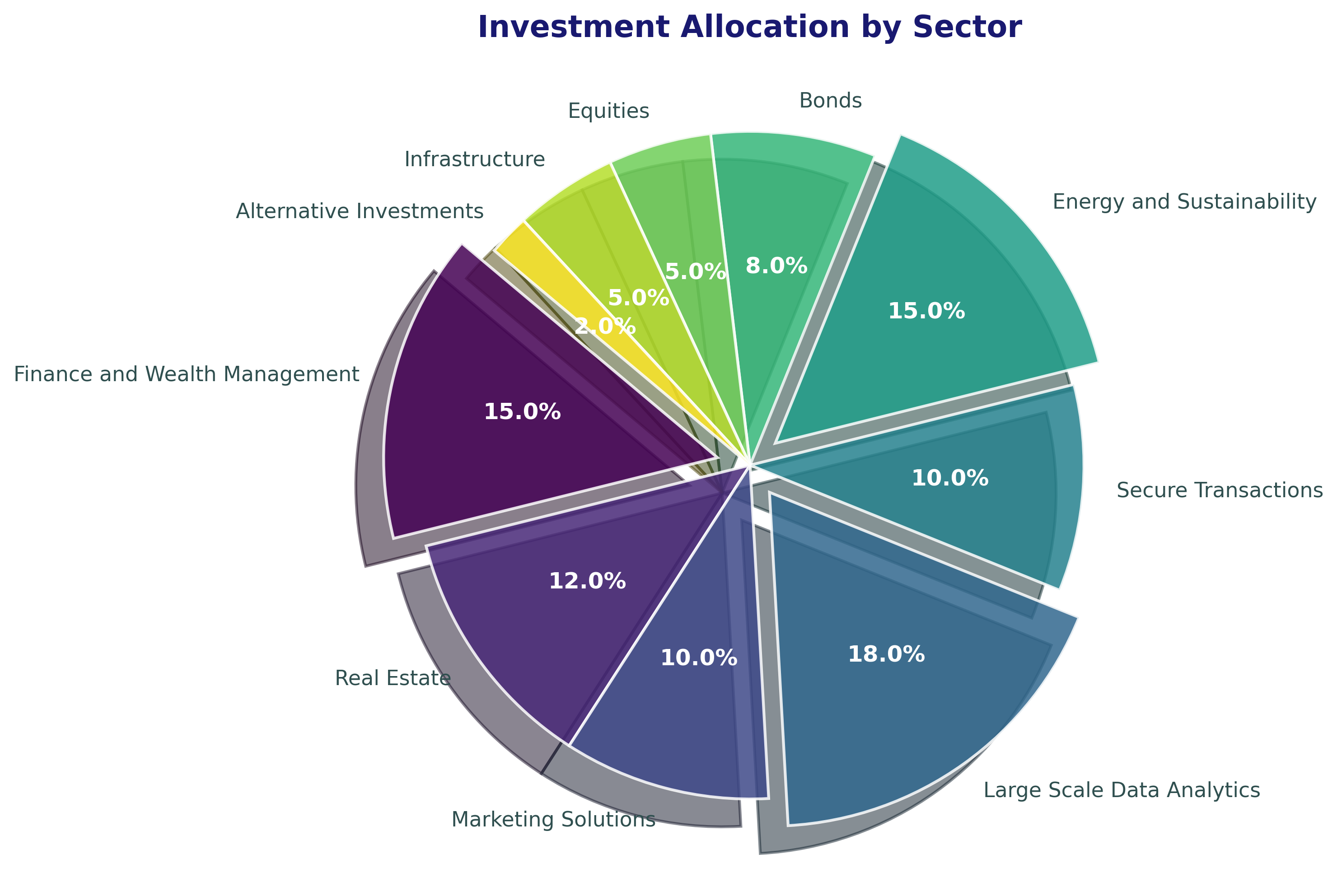

We Maximize Your Impact

Delivering Excellence to Our Clients

Finance and Wealth Management for Our Clients

We safeguard multigenerational family wealth with dedicated family office services, ensuring a seamless transition of assets across generations.

Real Estate

We specialize in maximizing the value of land, leasing commercial properties, and constructing both towering skyscrapers and residential projects.

We Help Leaders Reach Their Voice

At Bridge Marketing Solutions, we elevate our clients’ profiles by crafting tailored communication strategies that ensure their messages resonate effectively with the targeted demographics.

Large Scale Data Analytics

Our decision-making processes are powered by ‘Gilgamesh,’ our proprietary data analytics platform. This sophisticated tool underpins the strategic decisions across our subsidiaries, delivering robust analytical insights.

Secure Transactions

We are committed to enhancing liquidity for our clients by facilitating seamless cash transactions across global financial markets.

Energy and Sustainability

We are dedicated to fostering sustainable development by advising corporations and investors on strategic investments in future energy solutions.